How to Find the Best Deal on Your Mortgage

When

you go out shopping, most of us would really go out there and find the best deal that you can find.

This is in order to get the best value for your money. This is also quite well

and true when it comes to buying a home but it also comes in a bigger perspective.

When buying a home, you will not only

shop for a home but you would also need to shop around for a home loan.

The key to finding the best deal for your mortgage

is to also shop around, as with any other shopping, it is advisable to don’t

stop at the first option that you get. If you are able to get even a little bit

of savings on your monthly payments, it could still go on a long way.

Before

you go out there and shop for a home, make

sure that you consult with a mortgage professional to check whether your credit

is in good order, otherwise it could take months to correct. Another point

to consider is that how much house you can afford? A good mortgage professional

will be able to lead you as to what is the best loan that will fit you and your

needs.

Here

are also some great tips on how you can be able to get the best deal for your

mortgage:

Get your free credit report – this is quite paramount

because you will be able to know where you stand and get to plan ahead and see

as to what is the best option for a loan you can get.

Compare everything – when getting quotes from

different companies, don’t just look at the interest rates. Buyers should also

look and compare all the rates and fees; this includes origination fees, points

and other fees charged by the lender.

Interview the actual person who will

handle your loan

– they could either be a mortgage broker, a bank employee or a loan officer. It

is best to check for their qualifications and experience because even good

companies hire really bad people.

Make sure that lenders offer the best

program for you

– not all lenders offer FHA, VA or USDA Rural development loans. Loan-to-value

ratios and credit requirements also vary by lender. Variety can always provide

consumers with the option to get the best of everything that the market has to

offer.

Give the loan officer all details about

your situation when asking for quotes – change in circumstances can either

make or break your loan application, this is why it is important to give them a

thorough explanation of your circumstance whether you have suffered foreclosure

or recently changed careers so that the loan officer can be able to provide you

with the best option for your loan.

Paying more upfront or get a lower

interest rate?

– that actually depends whether you are planning to keep the loan for 30 years,

then it is advisable to pay more upfront in order to get a lower rate. But if

you are thinking of selling or planning for a refinance over the next few

years, then paying more won’t make any sense.

Ask what documents will be required – Find out what is required

so that you can be able to prepare and provide the necessary documents for a

loan application.

Get to know who you’re dealing with when

you fill out an online form for rates – A human broker can provide you with a

sound advice for your mortgage, while some online forms will reject your

application without even knowing the real score and leave you out of the blue.

Some application online will ask for your significant personal information

before giving you quotes.

Plan for costs that are not charged by

the lender – plan

ahead for additional costs such as title insurance, real estate transfer tax

and required escrow for property taxes and homeowner insurance. This will save

you the stress and hassle by being prepared.

Ask for the Good Faith Estimate worksheet

and not just the GFE

– Since most people consider the Good Faith Estimate to be confusing. The GFE

is required by law, but will be replaced on August 1 with a more useful

document. In the interim, ask for the complete worksheet and make sure it

documents all the fees.

I

hope that this article will provide you with some great tips in order to find

the best deal for your mortgage. You can also get in touch with a professional

agent to assist you with your home buying process.

|

REAL ESTATE BROKERS OF ALASKA "TOP PRODUCER"

Alaskan Spirit Realty | (907) 868-2811

Real Estate Brokers of Alaska | 1577 C Street, Ste 101 | Anchorage, AK 99501

Hire a positive and proactive REALTOR® to help you find your next home!

Call or text 9078682811 for information on Buyer's Representation Services

(NO COST TO HOME BUYERS) or Request my services at www.alaskanspiritrealty.com

Search entire Alaska MLS for FREE at www.alaskanspiritrealty.com

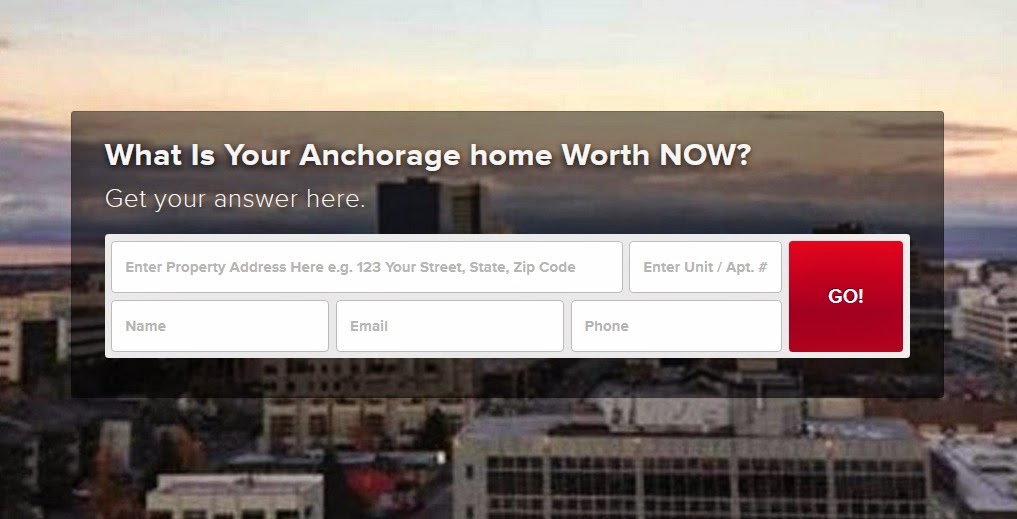

Do you need to sell your home? Get you FREE no obligation Home Evaluation and see how much your home is worth.

Comments

Post a Comment