November 2012 - Real Estate Market Update

The national housing (Real Estate Market Update) continues to

recover, indicated by consistent increases in both home sales and

prices. Inventories in much of the United States are primarily balanced,

which favors neither sellers nor buyers. However, large pockets of the

country are experiencing inventory shortages, which puts pressure on

prices. Many of the hardest-hit areas during the downturn now have some

of the tightest inventories. The return of price appreciation and a

stronger market, particularly in those locations, is a welcome signal of

returning market health.

• Low existing housing inventory. Only 1.9% month supply with new listings not supporting the current Monthly Sales Rate. This trend can not be sustained for a long time.

• Not many new developments in areas of high demand. We are seeing some developers start the process of bringing new homes to the market but not sufficient or timely to meet current demand.

• Distressed property sales are still significant at 32% of total sales, but trending lower from earlier this year. This is a healthy sign, as a lower distressed sales number indicates equity Sellers entering the market.

“Some buyers are frustrated with mortgage availability. If most of the financially qualified buyers could obtain financing, sales would be about 10 to 15% stronger, and the related economic activity would create several hundred thousand jobs over the period of a year,” states NAR President Moe Veissi.

Despite difficult mortgage qualifying conditions sidelining some buyers, others are still taking advantage of excellent housing affordability conditions, which is evidence of notable stored-up housing demand that accumulated since 2007. With the housing market coming close to a full recovery and mortgage rates hitting new record lows, the time to buy is now.

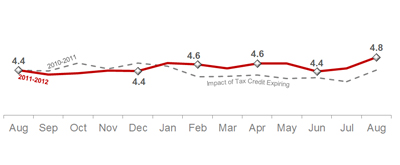

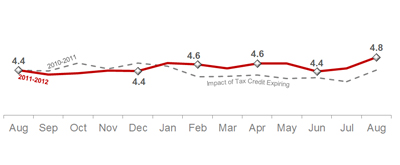

Home Sales In Millions Home sales this month rose 7.8% from last month to a seasonally adjusted rate of 4.82 million units, a 9.3% increase from last year. Distressed homes (which include short sales and foreclosures that traditionally sell for 15%–20% less on average compared to nondistressed homes) accounted for 22% of August sales, down from 25% of sales last month and 31% of sales last year. Although the amount of distressed properties is decreasing from month to month, they are still high by historic standards as seen in this Real Estate Market Update.

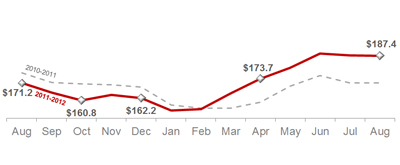

Home

Home

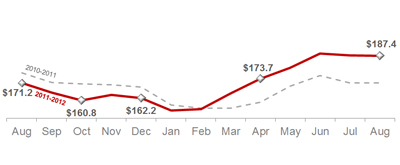

Prices In

Thousands Home prices continue to rise due to shrinking inventory and an increase in demand. The current median home price is $187,400, up 9.5% from a year ago and down just 0.2% from last month. This has been the sixth consecutive month of year-over-year price gains, the largest year-to-date rise since 2005.

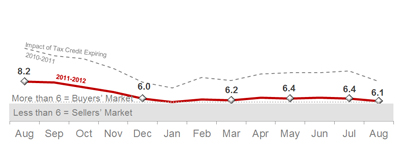

In Months

In Months

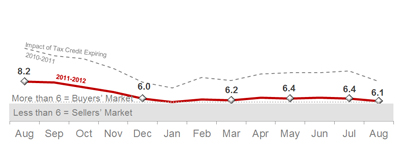

Housing inventory rose to 2.47 million homes available for sale—a 6.1-month supply—up 2.9% from last month and down 18.2% from last year’s 8.2-month supply as seen in this REal Estate Market Update. This marks the ninth consecutive month of inventory at a 6-month supply, a clear indicator of a balanced market and full-scale housing market recovery. Robust improvement in employment is the primary concern remaining, and as that improves the housing market recovery will be on firmer footing for the future.

Source: National Association of Realtors

Source: National Association of Realtors

• Low existing housing inventory. Only 1.9% month supply with new listings not supporting the current Monthly Sales Rate. This trend can not be sustained for a long time.

• Not many new developments in areas of high demand. We are seeing some developers start the process of bringing new homes to the market but not sufficient or timely to meet current demand.

• Distressed property sales are still significant at 32% of total sales, but trending lower from earlier this year. This is a healthy sign, as a lower distressed sales number indicates equity Sellers entering the market.

“Some buyers are frustrated with mortgage availability. If most of the financially qualified buyers could obtain financing, sales would be about 10 to 15% stronger, and the related economic activity would create several hundred thousand jobs over the period of a year,” states NAR President Moe Veissi.

Despite difficult mortgage qualifying conditions sidelining some buyers, others are still taking advantage of excellent housing affordability conditions, which is evidence of notable stored-up housing demand that accumulated since 2007. With the housing market coming close to a full recovery and mortgage rates hitting new record lows, the time to buy is now.

Home Sales In Millions Home sales this month rose 7.8% from last month to a seasonally adjusted rate of 4.82 million units, a 9.3% increase from last year. Distressed homes (which include short sales and foreclosures that traditionally sell for 15%–20% less on average compared to nondistressed homes) accounted for 22% of August sales, down from 25% of sales last month and 31% of sales last year. Although the amount of distressed properties is decreasing from month to month, they are still high by historic standards as seen in this Real Estate Market Update.

Prices In

Thousands Home prices continue to rise due to shrinking inventory and an increase in demand. The current median home price is $187,400, up 9.5% from a year ago and down just 0.2% from last month. This has been the sixth consecutive month of year-over-year price gains, the largest year-to-date rise since 2005.

Housing inventory rose to 2.47 million homes available for sale—a 6.1-month supply—up 2.9% from last month and down 18.2% from last year’s 8.2-month supply as seen in this REal Estate Market Update. This marks the ninth consecutive month of inventory at a 6-month supply, a clear indicator of a balanced market and full-scale housing market recovery. Robust improvement in employment is the primary concern remaining, and as that improves the housing market recovery will be on firmer footing for the future.

Comments

Post a Comment